With the FindBiometrics Year in Review survey having closed last month, we have been digging into the results – collected from over 900 respondents – to glean insights on how those most familiar with the biometrics industry understand some of the most important issues facing it. Our first few reports on the survey results featured a strong focus on the impact of COVID-19 – which is pretty much inescapable. But today, we’re going to take a step back and look at responses to a question with more general implications for the biometrics industry, pandemic aside.

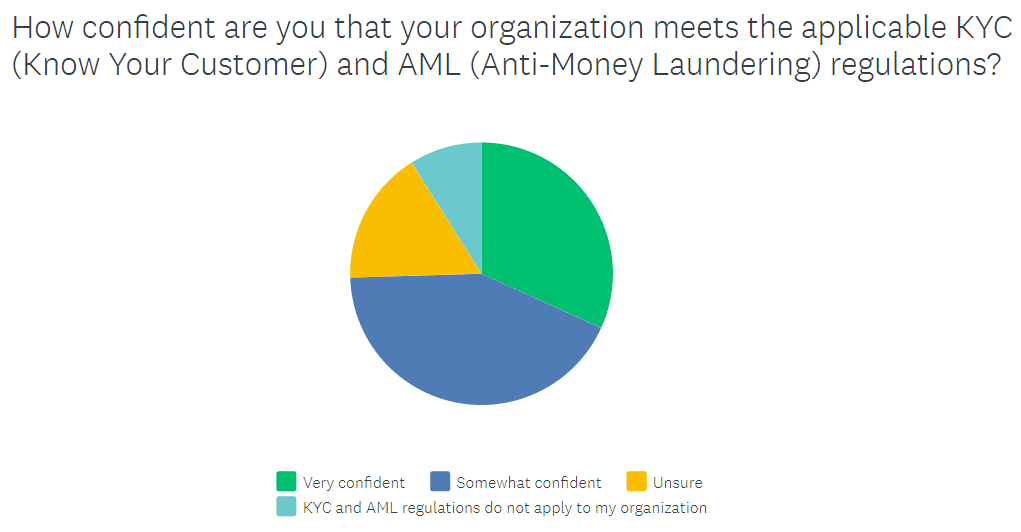

The question, sponsored by Jumio, asked the following: “How confident are you that your organization meets the applicable KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations?“

It’s a fitting question for Jumio to ask. Specializing in selfie-based authentication, in which facial recognition technology is used to match end users’ selfie photos to their identity documents, Jumio launched a KYC platform called ‘KYX’ (for ‘Know Your Everything’) in September, and almost immediately followed that up with its acquisition of AML startup Beam Solutions. AML and KYC compliance are a critical focus area for Jumio.

But they’re important for a growing number of other organizations, too. The wave of digitization that has swept various sectors over the past couple of decades only intensified during the COVID-19 pandemic as various companies, government agencies, and other organizations were compelled to transition their activities into digital channels. Regulators will therefore be more intent than ever on attacking digital fraud and cybercrime, and it’s a fair bet that frameworks along the lines of Europe’s PSD2 and California’s CCPA will continue to emerge and evolve.

That, in turn, will prompt more organizations to look for the kinds of streamlined solutions that are enabled by biometric technologies to make sure they know who their customers are and that their businesses aren’t being used for money laundering and related criminal activities.

Demand for such solutions is already strong – as we saw last week, a number of biometric onboarding specialists saw record growth last year; and this week alone has already brought the news that Jumio, for its part, has hired three new sales executives to help accelerate its momentum into 2021. But it would seem that the addressable market is large and growing.

The Year in Review’s question about AML/KYC compliance can’t tell us just how big that opportunity is in the broader market. Instead, it can give us some indication of the level of enthusiasm for biometric AML/KYC compliance solutions among the organizations that are most familiar with them.

The vast majority – 74.5 percent – expressed confidence in compliance, with about 31.8 percent saying that they were ‘very confident’ that their organizations meets KYC and AML regulations. What’s more, 8.9 percent said that such regulations don’t apply to their organization, making the ratio of compliance even stronger.

Bearing in mind that the Year in Review survey is a poll of individuals who are either working in the biometrics industry or closely associated with it, the results suggest that familiarity with biometric AML and KYC solutions results in enthusiasm for these technologies. Respondents’ organizations are at the vanguard of adoption, in other words; and given their confidence in compliance, that bodes well for the broader market as more regulations are put into place, and more executives and administrators learn about biometric solutions.

*

The 2020 FindBiometrics Year in Review is made possible by our sponsors: Aware, BioConnect, FacePhi, Innovatrics, Jumio, NEC Corporation of America, and Onfido.

–

February 3, 2021 – by Alex Perala

Follow Us