Physical banks aren’t going anywhere anytime soon, but they are clearly becoming less necessary as more financial services business is conducted online and through mobile devices. And with that trend in mind, one of the more forward-looking results of the 2018 FindBiometrics Year in Review survey makes a lot of sense.

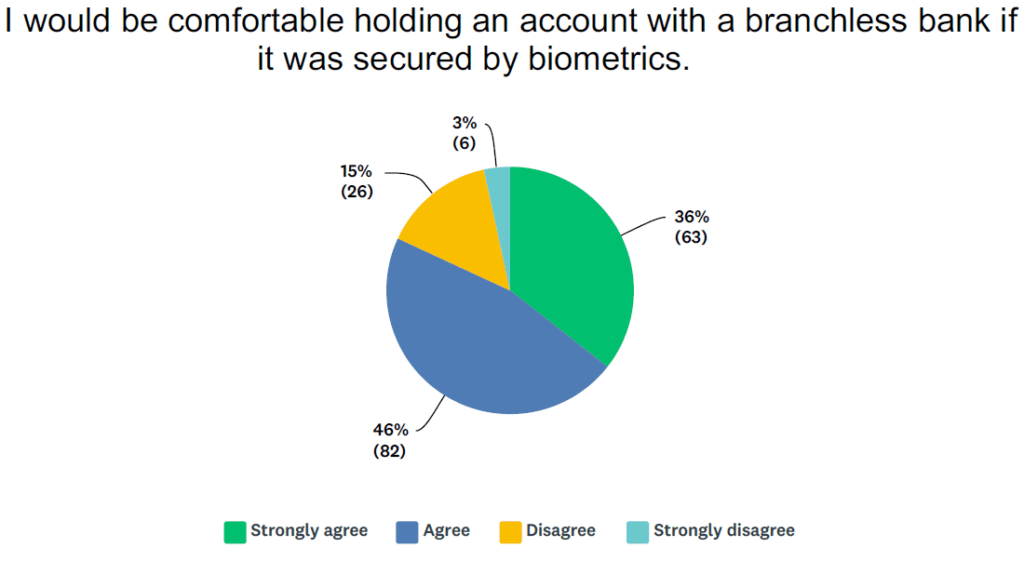

Question 15 of the survey asked respondents how much they agreed with the following statement: “I would be comfortable holding an account with a branchless bank if it was secured by biometrics.” A huge majority – 82 percent – agreed, with 36 percent indicating that they ‘Strongly agree’; and only three percent said they ‘Strongly disagree’.

It’s a remarkable result for its seeming rejection of the need for a bank to have any real physical presence. Purely digital banks do currently exist, but they remain the exception; and it’s hard to imagine that such a vast majority of everyday consumers would feel comfortable doing business with such entities today.

The industry insiders who responded to the FindBiometrics Year in Review are another matter. Their familiarity with biometric authentication means that they understand the technology’s transformative power with respect to how all kinds of sensitive business can be done: Sufficiently sophisticated biometric authentication systems already allow for everyday transactions to be done online, and even for highly sensitive corporate business to be transacted remotely. And the growing trend of selfie-based mobile enrollment means that many banks are now able to let customers set up new accounts without needing to see them in person.

That all points toward an all-digital future when it comes to banking, and such a business model will probably make more and more sense to bank administrators as digital and mobile banking continue their ascent.

–

January 22, 2019 – by Alex Perala

Follow Us