In December of 2017 FindBiometrics surveyed over 200 members of its informed audience – including executives from the world’s leading biometrics companies – on topics relating to the identity technology industry over the past 12 months. The results comprise the 15th Annual FindBiometrics Year in Review.

Last year, biomerics worked their way further into the mainstream, becoming common aspects of not only consumer lives, but across a wide range of markets. Indeed, biometrics are rapidly becoming synonymous with identity in our increasingly connected world, changing the way we consider finance, business, justice and the concept of nationality.

Last year, biomerics worked their way further into the mainstream, becoming common aspects of not only consumer lives, but across a wide range of markets. Indeed, biometrics are rapidly becoming synonymous with identity in our increasingly connected world, changing the way we consider finance, business, justice and the concept of nationality.

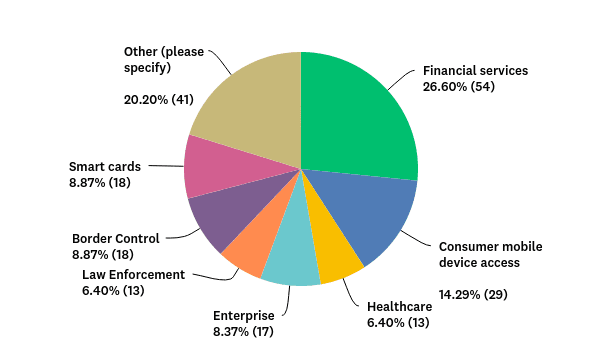

For the 2017 FindBiometrics Year in Review we asked our survey respondents to identify the year’s most interesting area of application for biometrics. Here is how the votes divided up:

Financial services was voted most interesting, with 26.6 percent, followed by consumer mobile device access, with 14.3 percent, and a tie for third place between border control and smart cards, which each hauled 8.9 percent. Notably, the ‘Other’ category, which allowed survey takers to write in individual responses, comprised 20.2 percent of the whole, indicating the widening breadth of application we’re seeing in biometrics at large.

Money Talks, Keeps Talking

It should be no surprise that financial services was voted most interesting area of application in biometrics by such a large margin. For years now, finance has been the market demonstrating how biometrics can make life easier, safer, and more fun, helping break negative stigma associated with biometry by giving everyday users something to do with the technology. The stakes are high in finance, and it is a relatively ubiquitous market, making the use cases accessible to a wide range of people. Biometrics help people pay for good an services, make banking more accessible, protect accounts from fraud, and reduce friction on call center channels.

In 2017 biometric finance continued to reach new users around the globe as the market evolved to better accommodate a strong-authentication and digital identity-powered future. Mobile wallets like Samsung Pay and Apple Pay – secured by fingerprint, iris, and face recognition – gained more support around the world, as banks continued to integrate biometric software – like FacePhi’s Selphi facial recognition – into their mobile apps. Financial service providers like Visa and Mastercard extolled the virtues of biometrics regularly in 2017, continuing to partner with identity and authentication vendors – as Visa did with Daon, bringing Identity X biometrics to Visa ID Intelligence. Meanwhile, public perception warmed as high profile data breaches highlighted the need for post-password authentication, stoking distrust in traditional IT security.

WEBINAR RECORDING: Watch Biometrics Industry Experts Discuss the FindBiometrics Year in Review

But the most remarkable aspect of financial biometrics in 2017 was its growing potential. Last year the foundations were laid for truly disruptive FinTech we’re on the verge of realizing now in early 2018. All year, we witnessed a pivot in fingerprint sensor markets as manufacturers like FPC, IDEX and NEXT Biometrics rapidly readied themselves for a boom in biometric payment cards, the first of which were trialed by Mastercard in early 2017 and are set to launch in the next few months. Trials of naked payments systems sprung up around the world, allowing customers to pay for a variety of goods and services – including fried chicken and hamburgers – with nothing but a biometric scan. Advances in artificial intelligence paved the way for invisible authentication and behavioral biometrics to be deployed, and also began to change the user experience, with virtual assistant like Siri and Alexa beginning to support financial transaction applications.

The future of biometric finance is exciting, and in 2017 we caught a glimpse of how. As observed by Money20/20 USA Chief Content Officer Andrew Morris in a recent FindBiometrics interview, the future of FinTech is going to be defined by different user experiences, and those experiences will be facilitated by AI and identity technologies including biometrics. In 2018, that future is now, and we are ready to see the next big advancements in the exciting arena of biometric finance.

*

Stay posted to FindBiometrics throughout January as we continue to analyze the 15th Annual Year in Review survey results.

The 15th Annual FindBiometrics Year in Review is brought to you by Leidos.

—

January 29, 2018 – by Peter B. Counter

Follow Us