Market watchers have predicted 30 of the last three crashes, but this time the tech bubble really does seem to be bursting. In April, the Nasdaq had its worst decline since 2008. Major tech companies like Amazon, Microsoft, and Alphabet have all seen declines of at least 20 percent of their market value this year. Apple’s value has declined by over half a trillion dollars since January.

So how will this affect the biometrics industry? It is, after all, a tech space. But it happens to be one that has seen legitimate and dramatic technological advancements over the past several years, and delivered real growth in terms of deployments and revenues.

Pulling Back

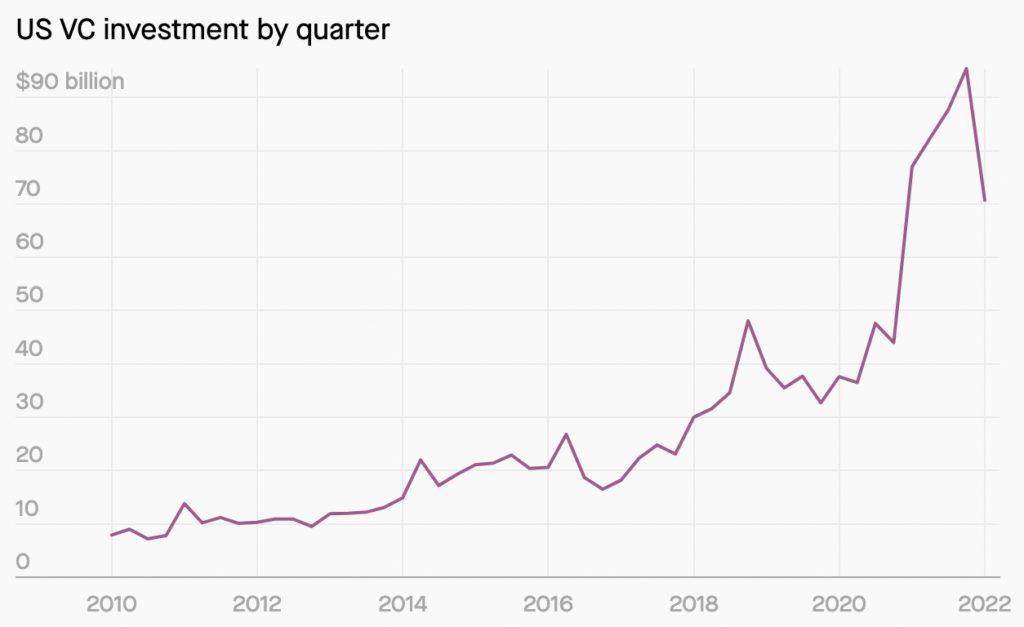

What’s happening in the public markets is what is most plainly visible, of course. But in the private markets a similar dynamic seems to be unfolding. Over the past couple of years, venture capital has been pouring into startups and pre-IPO firms, but that may now be slowing to a trickle.

According to PitchBook, in the first quarter of this year venture funding in the US fell by eight percent year-over-year. D1 Capital Partners, as an example, has gone from participating in about 70 startup deals last year to an abrupt stop this year, putting new investments on hold for at least six months, according to a New York Times report.

Speaking to NBC News, tech investor Zach Coelius described a bubble dynamic that led to frothy spending last year and is now unwinding.

“Everyone was aggressively writing checks really, really rapidly, and that trains founders into a ‘FOMO’ mentality — you had to move quickly or you were going to lose,” he said. Now, in 2022, with interest rates and inflation on the rise and supply chains still in turmoil – not to mention war in Europe – a disappointing earnings season has delivered “a comeuppance for a lot of folks,” he said. “Almost all the major public tech companies missed their numbers, and when that happens, the tide can turn really aggressively.”

The Rogue Wave

For several companies operating in the biometrics segment of the tech sector, however, that hasn’t quite been the trend. Companies like Aware and Imprivata have reported strong year-over-year sales figures, and vendors in the selfie-based remote onboarding space in particular have continued to see phenomenal growth.

But is that growth sustainable, or is it a bubble of its own? As Acuity Market Intelligence’s renowned analyst Maxine Most warned in a blog post last year, the unique conditions of the pandemic created a “Rogue Wave” that brought a flood of demand into the identity verification market in particular, and not every operator was going to be able to scale quickly enough to survive in the long run.

“Every company that experienced this phenomenon believed it was due to their superior offerings, strategy, staff, and business development skills,” Most told me via email. “In truth it was a sudden, unsustainable and extraordinary period of growth that picked up every market player.”

Most added that she had warned last year that “the wave would likely crash in 2022, bringing down market players that had not built a truly strategic, market-focused business strategy.”

The End of the Party?

This is something that early investors are going to be worried about amid current market conditions. And while it’s too early to tell just how dramatically these conditions are going to impact investment in the biometrics sector, there are a couple of signals that may be worthy of attention.

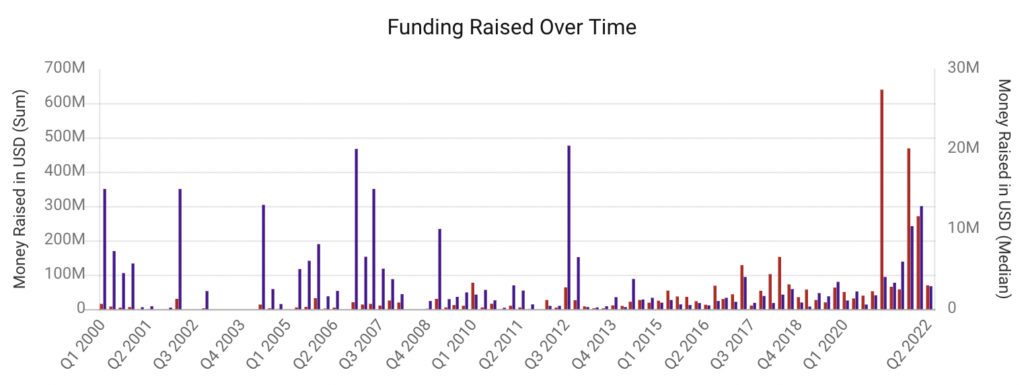

Data collected by Crunchbase suggests that VC funding for biometrics companies is already collapsing. Investment in the space dropped from $468.4 million in Q4 of 2021 to $270.7 million in Q1 of 2022. About halfway through Q2 of this year, funding amounts to $68.9 million.

Looking at biometrics startups in particular, funding dropped from $428.6 million in Q4 to $121.4 million in Q1, to $58.4 million at the time of writing.

So is the party over? For some, the answer is probably yes. Asked to assess the situation via email, one senior executive with a leading biometrics company framed it in blunt Darwinian terms. “A lot of uninformed (aka, dumb) money will start to pull back,” he wrote. “I expect to see new players in this field to slow down very soon.”

That having been said, there may still be plenty of opportunity for biometrics companies – including startups – that have compelling technologies and business strategies.

The Money Is Still There

The thing is, investors are still sitting on a ton of money. According to Pitchbook, United States-based VCs raised more money for new funds in the first quarter of this year than they had in all of 2019. They just haven’t been spending it amid the recent downturn, and going forward, they’re going to be more discerning in how they do so.

Commenting to The Washington Post, unnamed VC investors said that they’re looking for startups that focus more on their burn rate and ensuring that they’re spending their money wisely and efficiently. Shasta Ventures co-founder Tod Francis, meanwhile, explained that investors “will be putting more value in business models and capital efficiency,” while Sapphire Partners’ Beezer Clarkson emphasized that “[l]ooking at metrics should not be a negative.”

The sentiment is being echoed within the biometrics industry, whose “Rogue Wave” lifted all ships, including some that were not necessarily built for choppy waters.

“I think cycles are to be expected in the market and there were a lot of interventions in the economy during the pandemic, such that, if you’re a macro economist, none of this should be a surprise,” commented Frances Zelazny, an industry veteran with over 20 years of experience in biometrics. Having helped to scale Visionics into L-1 Identity Solutions, which was acquired by Morpho (now IDEMIA), and then served as Chief Strategy and Marketing Officer, and later Strategic Advisor, for the behavioral biometrics pioneer BioCatch, Zelazny embarked last year on her own startup, Anonybit, which is pioneering a decentralized approach to biometric authentication.

Anonybit raised $3.5 million in a seed funding round earlier this year, but Zelazny is realistic about what the broader trends in the markets mean for the biometrics and identity space going forward.

“As a CEO, it would be a little bit arrogant to say that the biometrics industry is isolated from the larger market forces because I don’t think that that’s true,” she told me. “I think investors are just going to be – like in all downturns – they’re just going to be more picky, and make sure that the fundamentals are there.”

Zelazny also emphasized the unique role that the biometrics and identity industry is serving in the current environment of digital transformation and evolving privacy regulations. Cyberattacks are a greater concern than ever, and at the same time there is growing pressure to ensure privacy protections for citizens and consumers, with political and regulatory entities around the world working on increasingly stringent regulations.

“I think the problems that this industry is solving are not going away, and I think it’s an opportunity to really focus on the things that will really move the needle for companies,” she said. “How do you stem identity theft losses? How do you ensure that your enterprise is protected from cyber-attackers?”

That focus on the longer-term mission, driven by fundamental market and regulatory trends, may be exactly what a lot of VCs will be looking for as they narrow their focus. Indeed, Quartz reports that with IPOs now seeing serious declines, venture capital is turning to startups facing a longer investment horizon, with Lux Capital partner Bilal Zuberi telling the publication that he expects VCs will now “try to look for diversity and longer term bets.”

Zelazny, for her part, says that Anonybit has already secured this kind of investor attention, and she suggested that in general terms the biometrics industry has tended to attract serious investors.

“I don’t think any of the investors that came in think this is like a quick win,” she explained. “They’re in it for the growth, they’re in it for the societal implications. So, I do think the industry will be affected, but… I think that what we’re doing is too fundamental to how we’re operating in a digital world, and those fundamentals don’t change regardless of what the stock price is or what Bitcoin is selling for or anything like that.”

Sources: The New York Times, The Washington Post, NBC News, Quartz, Crunchbase

–

May 13, 2022 – by Alex Perala

Follow Us