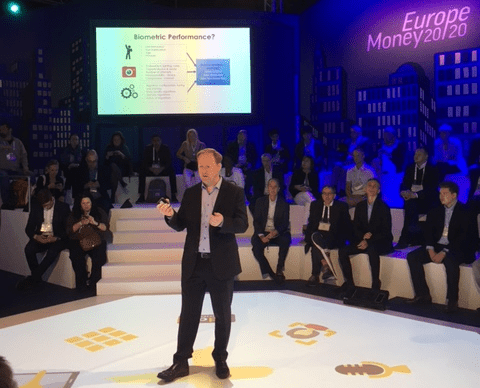

Like last year’s inaugural event, this year’s Money20/20 Europe conference and exhibition featured a wide range of exciting FinTech. Also like last year’s event, biometric technology proved to be extremely prominent. As commerce increasingly goes digital, biometric authentication has proven to be an effective and even necessary security measure, helping to ensure that customers are who they say they are when they’re not in front of the merchant in person. It has proven so effective – and indeed, so intuitive – that it’s even making its way into in-person payments.

In other words, the future of payments increasingly looks to be one facilitated by biometrics, whether those payments are made online or in person, and it’s already taking shape.

Here’s how:

Banks are getting access to even more extensive biometric authentication for their mobile services thanks to third party software:

Daon Integrates EyeVerify Tech Into IdentityX Platform

But physical payment cards are getting biometric authentication, too:

OT-Morpho Unveils Biometric Payment Card

IDEX’s Flexible Fingerprint Sensor Demonstrated

Hemant Mardia, CEO of IDEX, Talks Biometric Payment Cards [AUDIO]

And FinTech players expect the biometric payment experience to keep getting more intuitive – probably to the point where the consumer doesn’t even need physical technology to make a purchase:

FindBiometrics Panel Talks Consumer Education, Intuitive Authentication

Square is Ready For a World Without Payment Cards

Indeed, that’s already starting to happen as smart home AI assistants start to become users’ personal shoppers:

Alexa Can Take Prime Now Orders – from Chips to Cough Syrup, and Even Alcohol

Follow Us