All eyes are on Las Vegas this week as the biometrics and identity industries converge on Money20/20 USA, the world’s premier financial services and FinTech conference. The financial vertical has long been the front line for the rapid evolution of biometrics, and every year Money20/20 serves as the gathering place where identity industry professionals show off the state of the industry, on the exhibition floor and the event’s multiple stages.

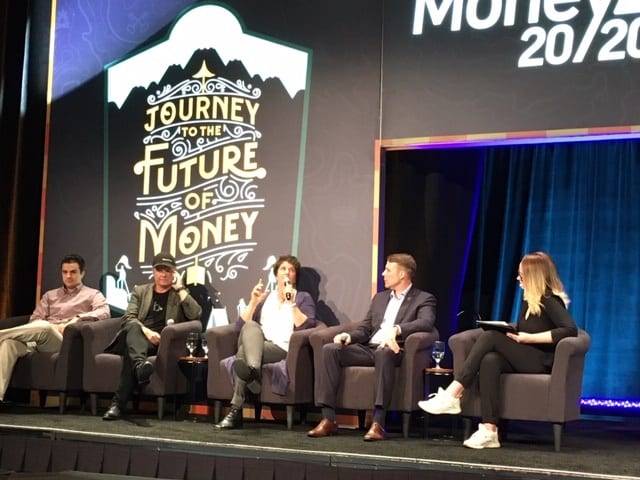

This year, FindBiometrics VP of Digital Content Susan Stover moderated a panel session: “Invisible Authentication: How UIX-Focused Biometrics Can Make Passwords Disappear.”

“For a long time this term ‘Invisible Authentication’ was unimaginable,” said Stover, introducing her panel. “Authentication seemed a friction-heavy process by nature. And the way we authenticated in our daily lives reinforced this contradiction: passwords were only as strong as they were complicated, and adding additional factors meant burdensome keys, tokens, and SMS-based one-time passcodes.”

Outlining the mobile biometric revolution kicked off by Apple’s launch of Touch ID, Stover traced the financial ID journey up to present day.

“Now, as FinTech morphs into its next aspect, thanks to financial inclusion in underserved regions, the rise of cryptocurrency, branchless banking, and naked payments, it’s time for biometrics to take their place not only as strong authenticators, but as an integral part of an intuitive user interface,” she said.

The panelists – Onfido CEO Husayn Kassai, BioConnect CEO Rob Douglas, IDEMIA Civil ID SVP Matt Thompson, and Acuity Market Research Principal Analyst Maxine Most – fielded questions about the implications of putting users in control of their identities, privacy practices under the shadow of facial recognition controversy, and the convergence of physical and information security.

Among the many heated discussion points, the panel weighed in on what biometric finance will look like in 2025 – particularly focusing on the identity brokers of the future, and the question of who is the best party to manage end-user identity. Douglas proposed the idea of an “identity bank” (not to be confused with financial banks), while Kassai forwarded an end user-centered approach. And while opinions remained divided, audiences were left with an illuminated view of the financial identity landscape.

But the conversation isn’t over: the topics discussed on Stover’s panel will be brought forward in the free follow-up webinar co-presented by FindBiometrics and Money20/20, “Biometrics and Money“, on November 13th.

Money20/20 USA concludes today.

October 30, 2019 – by Peter B. Counter

Follow Us