A few weeks ago, we looked at how the bursting tech bubble is affecting funding for biometrics companies in the private markets. It wasn’t pretty. Investment data and VC sentiment together painted a picture of a once-flooding stream of capital that was now starting to run dry. Executives from leading biometrics companies, meanwhile, suggested that changing market conditions would soon separate the wheat from the chaff.

The market outlook hasn’t really improved since that story was published. There is now a growing consensus that inflation and labor shortages are putting the US and other countries on track for a recession.

All that having been said, the macro-level factors driving these trends are complex, and outcomes will, to a certain extent, be nonlinear. Not every sector is going to suffer across the board, nor will every company within a struggling sector experience substantial turmoil.

On that note, it’s worth taking a moment to look specifically at what’s happening in arguably the hottest segment of the biometrics market – facial recognition – and to hear from an industry analyst who remains bullish about its prospects going forward.

Facial Recognition, From Different Angles

Making sense of private investment in the facial recognition space is a matter of perspective.

From one point of view, the space seems to be suffering from the bursting tech bubble just the same as any other. Last year, venture capital investment in facial recognition totaled $574.6 million, according to data compiled by Crunchbase. Now, almost halfway through 2022, just $44.3 million has been raised at the time of writing. That puts the industry on track for a serious drawdown in comparison to 2021 investment levels.

But there’s an interesting wrinkle to this perspective. All of the $574.6 million that poured into facial recognition firms last year came in the first three quarters. There wasn’t any disclosed VC funding in this space in Q4. None. It’s worth noting here that the fourth quarter of 2021 is when the prospect of serious inflation really started to filter into markets discourse, and when the Omicron variant of COVID-19 reared its head. These developments may have started to spook investors who might otherwise have dived into the facial recognition space.

Yet despite that dramatic pullback, investment started to flow again in early 2022, even as it became clear that overall market conditions were deteriorating, especially for tech companies. Selfie onboarding specialist Truora, for example, announced in April that a Series A funding round had brought in $15 million, while Humanode, a blockchain platform based on biometrically verified nodes, raised $2 million in seed funding. These investments, among others, complicate the narrative of a VC pullback prompted by public market declines that only started in earnest this year, as the tech bubble has deflated. Taken as a group, investors in the facial recognition segment seemed to put on the brakes in late 2021, and then to tentatively resume their activities in 2022. The timing doesn’t sync up with the narrative of the broader tech bubble, which only started to burst in Q1 of this year.

A Unique Investment Dynamic

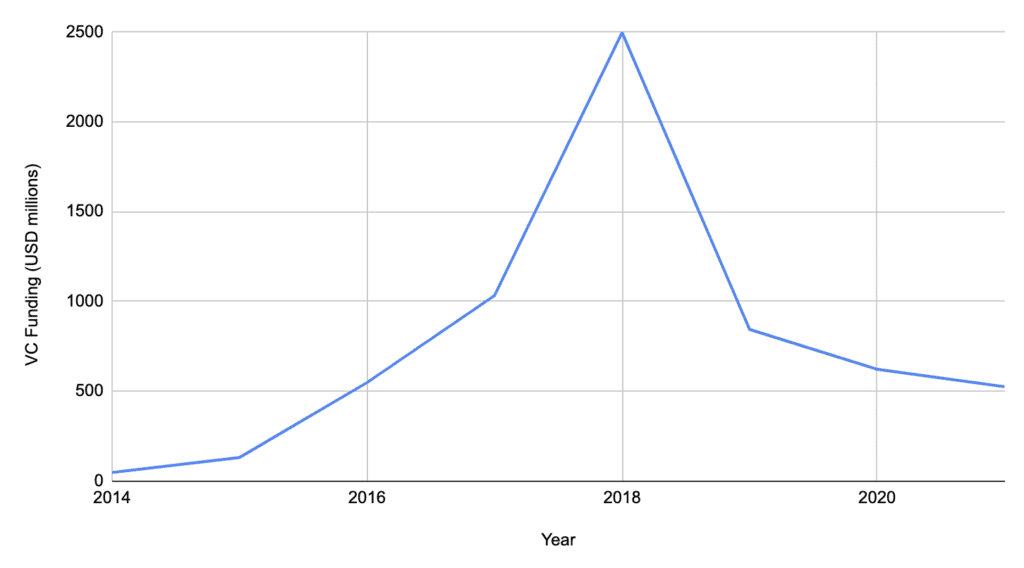

Zooming back for a look at the bigger picture complicates that narrative even further. As FindBiometrics reported last summer, VC funding for facial recognition companies had hit a high point in 2018, when it approached a cumulative total of $2.5 billion (for that year alone). When that particular feature came out, it seemed like another peak was on the way: well over $500 million in VC funding had flooded into facial recognition by mid-July of 2022, suggesting that the space was on track for a blockbuster year in comparison to 2020, when funding amounted to $622.5 million in total.

Now, of course, we know that things didn’t turn out that way. Funding dried up completely in Q4, and the total for 2021, as mentioned above, amounted to $574.6 million – less money than was invested the year before.

What this means is that VC investment in facial recognition really did peak in 2018. That was followed by a sharp decline in 2019, when $843.9 million was raised, and then gradual declines in the ensuing years.

From this perspective, it becomes clear that the facial recognition segment has been subject to its own particular VC funding dynamic, distinct from the one that fuelled the now-deflating tech bubble.

That tech bubble arose in part due to record-low interest rates and, arguably, government spending. A speculative frenzy was also important: as one tech investor quoted in our earlier ID Tech feature explained, VCs were in thrall to a ‘FOMO’ mentality, writing out checks as fast as they could.

Some of those trends surely influenced the facial recognition space, but again, this particular segment of the biometrics sector had already seen its VC investment peak back in 2018. Its bubble – if you can call it that – had long come and gone.

In her commentary for our earlier VC feature, seasoned biometrics executive Frances Zelazny had suggested that the biometrics industry tended to attract more serious investors with long-term outlooks, and she may have been right. They weren’t the ones inflating the tech bubble that has now wiped trillions from the Nasdaq.

Fit for the Ecosystem

None of this is to say that facial recognition won’t see a particularly strong drawdown in private investment during a likely bear market and possible recession. The $44.3 million that has been raised so far in 2022 suggests that the year’s total will fall far below that of 2021. But this area seems to have been at least somewhat insulated from the speculation and hype that fuelled VC investment in some other parts of the tech sector, and there is reason for optimism about the segment going forward.

“I’m definitely expecting that funding for facial recognition will increase over the next few years due to a couple of different reasons,” commented Frost & Sullivan Senior Industry Analyst Danelle VanZandt. Reached by email, VanZandt explained that the facial recognition industry is now reaching a stage of maturity in which a growing number of vendors can clearly demonstrate the accuracy of their solutions and explain how they work. A growing number are also demonstrating their solutions’ capabilities in overcoming the racial bias and privacy issues that have so far plagued the sector.

Importantly, the facial recognition industry now features respected third-party testing programs and regulatory frameworks through which vendors can validate the effectiveness of their solutions – and many are willing to do so. That helps them to make a strong case to discerning VC investors.

“Most of what I hear from facial recognition vendors is positive news about the potential for investment funding,” VanZandt said, “but one of the main criteria for many of these investments is that the facial recognition vendors can prove their accuracy and bias results via those industry standard tests and broad compliance standards, i.e. NIST recognition results in the United States or GDPR compliance.”

In other words, vendors that are able to prove the sophistication of their technologies against recognized standards are the ones that are going to get funding.

The observation would seem to track with those of our tech bubble commentators who suggested that the more competent biometrics vendors will survive the tech crash. Facial recognition has seen an especially rapid evolution over the past several years, and its industrial ecosystem is one in which vendors can leverage testing programs and regulatory standards to prove that they are the real deal. That, in turn, should help them to attract the attention of VC investors who are still sitting on piles of capital, but are now trying to be a bit more discerning in how they distribute it.

***

On that note, policymakers are continuing to develop laws and regulations that will add clarity for vendors and investors alike – another structural advantage of the space that is tied, to some extent, to political interests. We’ll delve a little deeper into that subject in our next ID Tech newsletter. Stay tuned.

Sources: Crunchbase, Fortune, CNN

–

June 9, 2022 – by Alex Perala

Follow Us