The financial services sector has shown a tremendous appetite for biometric technologies in recent years, and has been the site of some of the most exciting innovations in biometrics and related technologies. That’s why FindBiometrics has partnered with Money20/20 to bring readers a month-long special event on financial services biometrics.

Today, we’re kicking off our featured coverage with a look at how biometrics are helping to address some of the new challenges and incoming threats that the sector is seeing in 2020.

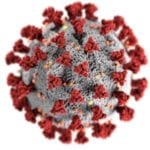

The Outbreak’s Impact

The most important trends in biometric FinTech were already underway going into 2020, but at this point we simply can’t avoid seeing how COVID-19 had impacted them. And it’s fair to say that the pandemic has accelerated the key trends.

It all revolves around digitization. Financial services providers have seen increasing numbers of customers moving into digital channels for years now, with online banking and mobile account access having moved into the mainstream relatively quickly. Likewise, digital threats have emerged, too, with fraudsters following end users into these mobile channels, and constantly on the hunt for security vulnerabilities.

COVID has intensified all of this. Reluctant to visit branches in person – or possibly restricted from doing so – vast numbers of financial services customers have been pushed into digital channels. Banks now face the challenges of processing significantly higher volumes online, and of ensuring that those who are less tech savvy will be able to use their remote services without falling victim to fraud and other cyberthreats.

Fortunately, biometric tools to address these issues were already available before the outbreak, and are now being honed to meet the specific needs of the COVID era.

Selfie Security

One of the most important technological developments in cybersecurity – and one that has proven highly popular in the financial services sector in particular – is the emergence of selfie-based biometric authentication.

A number of solutions are now available that operate on the same foundational principle: an end user uploads a selfie and images of official identity documents to the platform, and facial recognition is used to match the selfie to those documents. This allows financial institutions to remotely confirm the identities of their end users, and offers the latter a convenient means of proving they are who they say they are.

These selfie-based authentication systems are difficult to fool, especially since the more sophisticated solutions feature liveness detection technologies that are designed to spot potential ‘spoofing’ attempts in which fraudsters try to pose as legitimate users by means of photographs, masks, or even deepfakes. For banks and other financial services providers, this means that not only can they let customers securely perform transactions online, but they can even remotely process more sensitive activities such as opening new bank accounts.

Flagging Fraudulent Behavior

Selfie-based authentication offers a compelling solution to ensuring reliable authentication sessions online, but it can’t address every new threat in digital banking. Social engineering scams like phishing, for example, are a matter of serious concern for users who are new to digital banking and unfamiliar with standard security practices as well as the various scams that are out there.

This is where behavioral biometrics offer a unique solution. These technologies are designed to look for patterns in end user behavior that can offer assurance of user legitimacy and also flag activities that signal potential fraud. This means that even if a fraudster has acquired legitimate user credentials, patterns in how they enter that information online can trigger alerts for IT security officials, allowing them to take action as appropriate. Even in situations in which a fraudster gains access to an account, behavioral biometrics can automatically detect signs that something is amiss.

These kinds of solutions are of obvious value to financial services organizations, and, as with selfie-based authentication, the need for such advanced security has only intensified in the wake of COVID-19 and the digital traffic tsunami. There is plenty more to say about behavioral and selfie biometrics, not to mention the other challenges and threats that financial services organizations are now facing, so stay tuned as we continue to bring more featured coverage on financial services biometrics in the coming weeks.

*

Financial Biometrics Month 2020 is made possible by our sponsors: Onfido, FacePhi, and BioConnect.

–

October 8, 2020 – by Alex Perala

Follow Us