Payment giant Mastercard is pointing to another recent study that shows the threat that hackers and other cybercriminals pose to financial institutions, and how this threat has grown in recent months.

The study in question was conducted by Aite Group, and shows that nearly half of US-based consumers had experienced some form of identity theft between 2019 and 2020, while at the same time 37 percent of consumers were also victims of what is known as ‘application fraud’ — a type of identity fraud that sees bad actors take consumer information and use it to create new accounts for fraudulent activity.

Victims of application fraud can be subjected to high payments for loans or credit cards they didn’t ever apply for, and financial institutions can risk damage to their brand name as well as a loss of customers as a result.

Application fraud is also often misidentified as something else, and oftentimes a financial services company’s internal security team ends up blaming the victim of the attack for something like an unpaid line of credit, making it difficult to spot or define application fraud within an organization.

“The lack of definitions complicates how application fraud is measured. Improper definitions lead to unreliable metrics, making it difficult for FIs to know how large of a problem application fraud is within their systems,” notes a Mastercard blog post discussing the survey findings. “And without an accurate understanding of application fraud attacks, FIs won’t truly know if their security efforts are making an impact.”

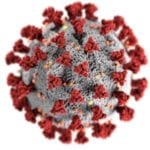

Among the many impacts of the COVID-19 pandemic has been an accelerated growth in instances of fraud, identity theft, and other forms of hack attacks and cybercrime. Lockdown and stay-at-home measures that have been implemented throughout the world have led to a dramatic increase in the amount of online activity, with record numbers of people spending more time at home online doing things like working, banking, shopping, and attending classes.

–

May 19, 2021 – by Tony Bitzionis

Follow Us