Welcome to the newest edition of FindBiometrics’ AI update. Here’s the latest big news on the shifting landscape of AI and identity technology:

The Federal Trade Commission has embarked on a “study” of AI investment deals made between OpenAI and Microsoft, as well as Amazon, Google, and Anthropic. In announcing the investigations, FTC Chair Lina Khan explained that they’re aimed at shedding light on whether the deals “risk distorting innovation and undermining fair competition.” But her agency is still negotiating with the Department of Justice about who should investigate the Microsoft-OpenAI partnership.

A new analysis questions the wisdom of investing in AI startups. Anthropic’s gross margin was in the 50-55 percent range in December, according to a report from The Information. Average gross margin for cloud software companies is 77 percent.

Microsoft, meanwhile, is still in a weird state of pseudo-competition with its biggest investment. The tech giant has set up a new “GenAI” team dedicated to building a conversational AI system that requires less computing power than OpenAI’s own ChatGPT.

Apple is quietly making a major AI push: It has acquired 21 AI startups since 2017, and has a significant number of AI job postings related to “Deep Learning”. Wedbush Securities analyst and Managing Director Daniel Ives tells the FT that Apple is “getting ready to do some significant M&A,” and that he’d be “shocked if they don’t do a sizeable AI deal this year”.

Meta is building an $800 million data center in Jeffersonville, Indiana, that will be primarily dedicated to AI compute. It will be Meta’s 22nd data center, but the first to focus on AI. It won’t be ready until 2026.

Google has agreed to host Hugging Face AI software on its cloud computing network, positioning it to become a more important platform for the open source development community. Based in New York, Hugging Face is known for its open source libraries of AI models.

Three of Google’s AI researchers have departed to start their own startup focused on AI-generated music. They were reportedly frustrated with the slow churn of Google’s bureaucracy. Now, they have raised $8.5 million of a $10 million target, and have met with Andreessen Horowitz and others to get more.

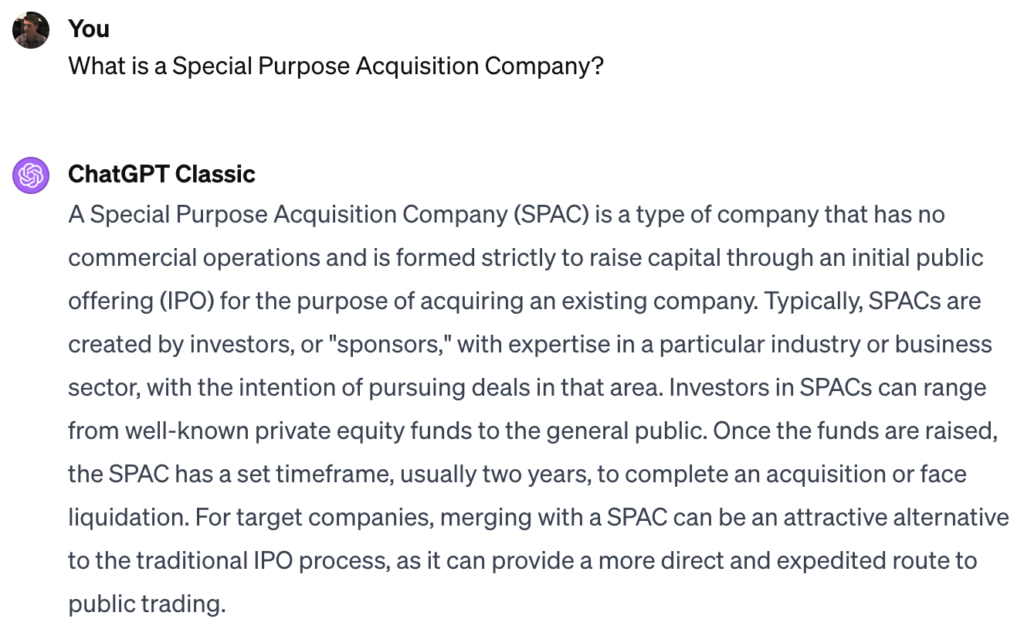

Fusemachines Inc. has entered into a $200 million merger deal with a Special Purpose Acquisition Company, CSLM Acquisition Group, that is expected to take the AI firm public by the end of the second quarter. The firm has been working on AI for 11 years and its clients include Time Inc. and the City of New York.

The chatbot’s take: We asked for a bit of clarity on an unusual Wall Street investment vehicle.

–

January 25, 2024 – by Alex Perala

Follow Us