Welcome to the latest edition of FindBiometrics’ AI update. Here’s the latest big news on the shifting landscape of AI and identity technology:

CoreWeave, which rents access to Nvidia’s much sought-after chips, has lowered its business expectations for the year. In April, it told investors it expected about $630 million in revenues and $3.3 billion in capital expenditures; but in a note to investors in June, those numbers were revised down to a little over $500 million and $2.3 billion, respectively.

Applied Materials, on the other hand, is expecting Q4 sales of about $6.51 billion, compared to analyst estimates averaging $5.88 billion. Applied Materials is the biggest US-based manufacturer of chipmaking machinery. CEO Gary Dickerson says excitement about AI, as well as the continuing proliferation of internet-connected devices, are putting his firm on track for “sustainable outperformance” in 2023.

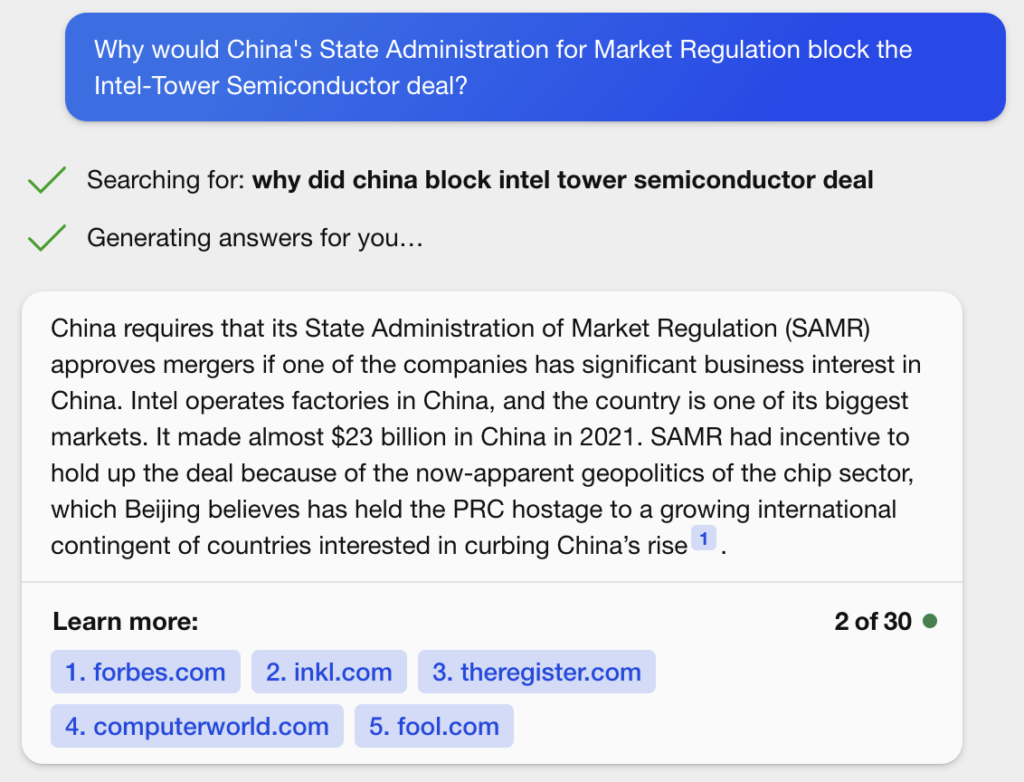

Intel has abandoned a plan to acquire Israel-based chipmaker Tower Semiconductor due to difficulties in obtaining approval from Chinese regulators. Deals between large multinational corporations that that generate over Rmb 400 million, or roughly $55 million, in revenues in China are required to get the approval of the State Administration of Market Regulation. The deal would have been valued at $5.4 billion.

Modular is looking to reach a valuation of about $600 million through a Series A funding round that may be led by General Calayst, a Cambridge, MA-based VC firm. Modular recently launched flagship software that allows developers to train their AI systems on chips from a range of companies including Intel, AMD, and Google. By contrast, Nvidia’s popular machine learning software, Cuda, only works on Nvidia chips.

Japan’s SoftBank has taken full control of the UK-based chip designer Arm, buying out the remaining 25 percent stake it did not own from Saudi Arabia’s Vision Fund. The agreement valued Arm at $64 billion. Arm is expected to make its IPO on the Nasdaq next month. A previous effort to sell Arm to Nvidia did not get regulatory approval.

Former Google researchers Llion Jones and David Ha have co-founded a new, Tokyo-based startup called Sakana AI. The pair aim to build a generative AI platform for text, images, code, and other media whose construction will be inspired by the flexible biological systems found in nature, which the scholar Nassim Taleb might characterize as “antifragile” for their ability to withstand stressors and shocks. Jones had been part of a group that instrumental in pioneering generative AI through the publication of an influential research paper in 2017, while Ha led research at the image generation startup Stability AI.

TECH5 has received a US patent for the neural network-based biometric scanning and liveness technology used in its T5-AirSnap Finger solution. Patent 11721120, titled “Contactless fingerprint capture using artificial intelligence and image processing on integrated camera systems”, details a system that, among other things, produces a 3D depth map of a finger enabling 500 dpi resolution.

VSBLTY has upgraded the architecture of its computer vision-powered security solution, moving from a CPU-only system to one outfitted with an Intel CPU together with the Intel Data Center GPU Flex 170. The company says that the move has significantly improved the performance of its Vector Weapons Recognition product, reducing its number of false positives. Its Vector platform also supports facial recognition, and is designed to automatically alert security personnel when a potential threat is detected.

The chatbot’s take: Bing seems to agree with some of the Financial Times‘ analysis of Intel’s aborted acquisition effort.

–

August 21, 2023 – by Alex Perala

Follow Us